Example: A US multinational company with subsidiaries around the world, including

Australia, recently prepared new US transfer pricing documentation.

The company applies their transfer pricing policies on a global basis. The US tax director instructs the Australian tax director to use this documentation to support the prices charged by the US Company to the Australian subsidiary. Is the US documentation acceptable in Australia?

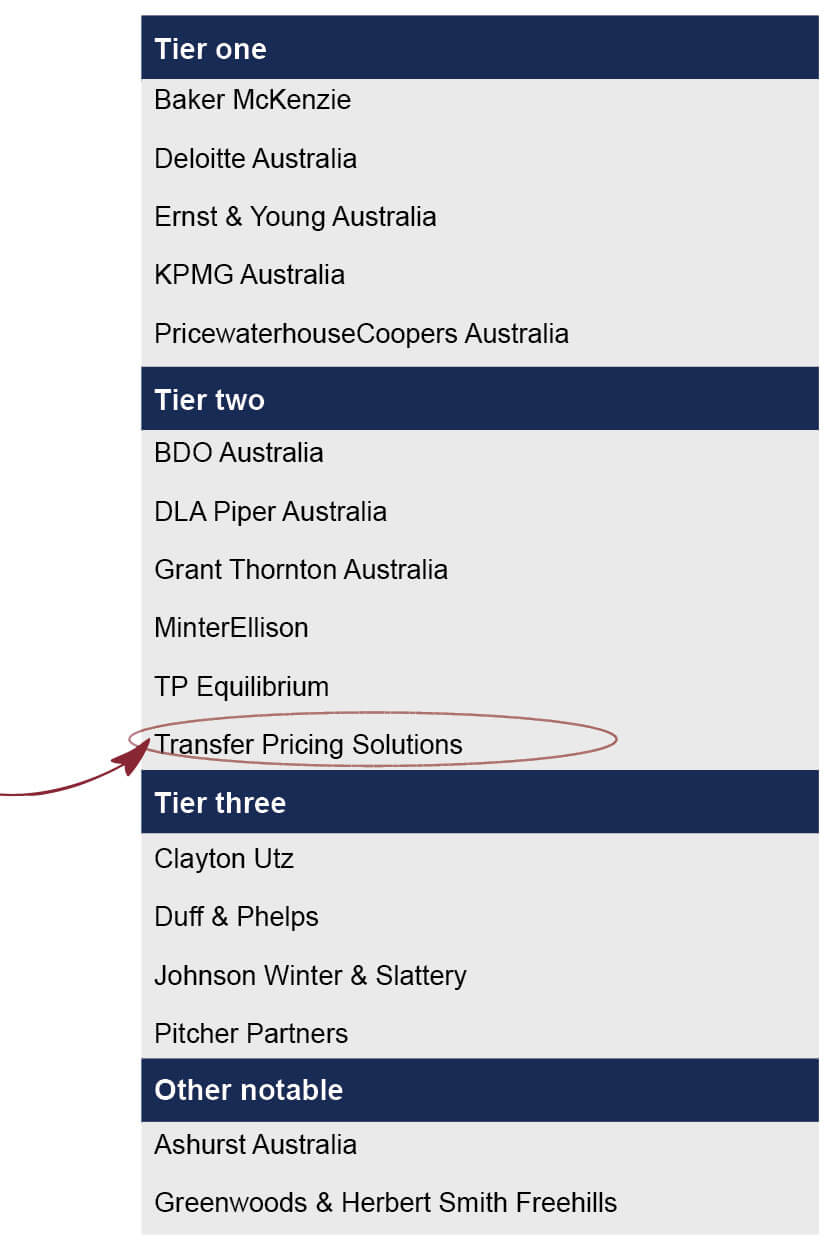

We are a boutique Tier 2 transfer pricing firm that partners with multinational firms, applying our

experience and expertise in transfer pricing to provide, prepare, document and assist in defending your international related party

transactions.

Does your foreign-prepared transfer pricing documentation offer the following:

|

|

Adherence to AU laws and regulations |

|

|

Perform local benchmarking |

|

|

Penalty protection and reduce risk of audit |

|

|

Relevance to local operations |

We'd love to chat further. Please get in touch to discuss how Transfer Pricing Solutions can partner with you.

T: (03) 5911 7001

E: hello@transferpricingsolutions.com.au