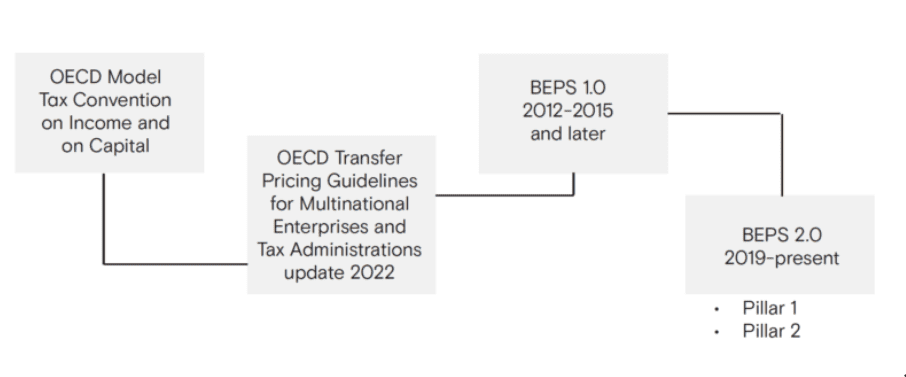

The OECD's endeavor to better tax the MNEs is an ongoing one. Its next project as stated earlier is BEPS 2.0, which is triggered by the

current digitalization of the world economy. In January 2019, the OECD issued a policy note introducing a two-pillar approach.

Pillar One addresses profit allocation issues in the context of digital business activity to ensure that MNEs pay a fair share of tax

wherever they operate. Pillar Two addresses broader BEPS issues and may result in international minimum taxation.

BEPS 2.0 is designed to attribute more value from remote business activity to the markets involved, allocating a larger share of profits based on the customer base in various locations.

As of November 4, 2021, 137 countries and jurisdictions agreed to the two-pillar plan as a solution to aligning international taxation rules with the digital world.